Climate Change Initiatives

ESG Report PDF (2.8MB)

GRI Standards Comparison PDF (369KB)

- Awareness of Climate Change

- Basic Policy / Commitment

- TCFD

- Information Disclosure Based on TCFD Recommendations

Awareness of Climate Change

Progress in climate change is a scientific fact as indicated mainly by the Paris Agreement (2015), IPCC Special Report (2018) and IPCC Sixth Assessment Report (Working Group 1, 2021), and the progress in climate change is expected to result in the occurrence and expansion of weather disasters such as the intensification of typhoons and heavy rains, the frequent occurrence of heat waves and droughts and progress in global sea level rise.

Achieving net zero by 2050 is increasingly necessary as a global effort to mitigate climate change, and the transition to socio-economic decarbonization and its process may have a significant impact on NIPPON REIT's business.

NIPPON REIT recognizes that it is essential to enhance the resilience of its businesses by identifying, assessing and managing risks and opportunities that may be brought about by climate change from a range of perspectives, including the securing of NIPPON REIT's sustainable and stable profitability on a long-term basis.

Basic Policy / Commitment

SRA supports the international goals set out in the Paris Agreement and will continue to promote initiatives to achieving net zero GHG emissions to contribute to climate change mitigation.

TCFD

In December 2022, SRA announced its commitment to TCFD(Task Force on Climate-related Financial Disclosures).

In addition, SRA joined TCFD Consortium, an organization formed by domestic companies that support the TCFD recommendations.

TCFD Consortium aims to discuss measures that lead financial institutions, etc. to appropriate investment decisions based on appropriate information disclosure by companies and disclosed information.

TCFD Consortium exchanges views on initiatives to address climate-related issues and how to disclose relevant information and utilize information.

Please click here for the details of TCFD

Please click here for the details of TCFD Consortium

Information Disclosure Based on TCFD Recommendations

Governance

The operating officer for climate-related issues at SRA will periodically provide a report about matters related to climate change initiatives, such as the identification and evaluation of the impact of climate change, management of risks and opportunities, progress of initiatives pertaining to adaptation and mitigation, and establishment of metrics and targets, to the chief executive (President & CEO) in charge of climate-related issues at the Sustainability Promotion Committee in accordance with the Climate Change and Resilience Policy.

Policies, targets, and various measures related to climate change that have been drafted by the relevant divisions are discussed and examined by the Sustainability Promotion Committee and then determined by the Chief Officer of climate-related issues.

Discussions at the Sustainability Promotion Committee are reported regularly to the Board of Directors of SRA and the Board of Officers of NIPPON REIT.

Strategy

Scenario Analysis

To identify risks and opportunities related to climate and identify, evaluate and manage their impacts on the management activities, strategies and financial plans of NIPPON REIT, we examined changes in the external environment in 2050 and how they may affect our business by referring to the following "scenarios" published by international organizations, etc., and assuming changes in the world under each scenario.

| 1.5℃ scenario | 4℃ scenario | |

|---|---|---|

| Transition Risks |

IEA (International Energy Agency) World Energy Outlook2022 NZE2050 |

IEA World Energy Outlook 2022 STEPS |

| Physical Risks |

IPCC (Intergovernmental Panel on Climate Change) the Sixth Assessment Report SSP1-2.6 |

IPCC the Sixth Assessment Report SSP5-8.5 |

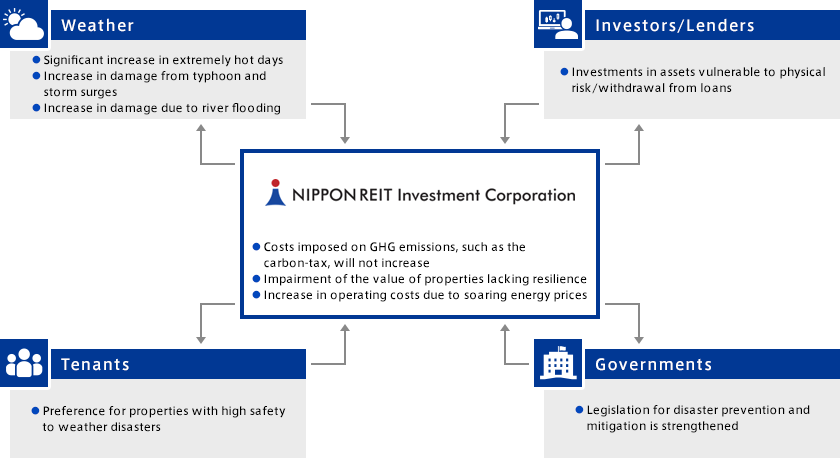

4℃ scenario

Scenarios in which climate change mitigation measures that exceed the current level are not realized, GHG emissions will continue to increase, and the physical risks of weather disasters will increase.

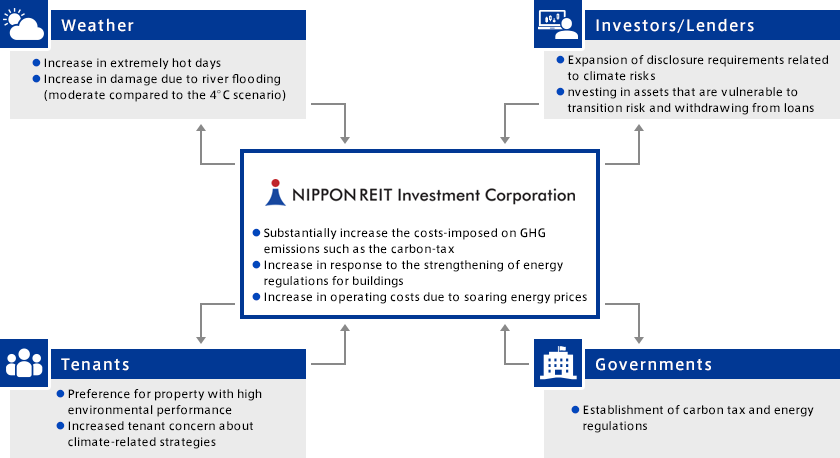

1.5℃ scenario

Scenarios in which social policies for decarbonisation, emission regulations and technology investment, etc. make greater progress than at present in order to achieve the Paris Agreement goals, and the transition risk becomes relatively higher

Risk Management

Identification of risks and opportunities, the evaluation of their financial impact, and our initiatives

Based on the scenario analyses, SRA has identified risks and opportunities and evaluated their impact on our business as shown in the table below.

| * | SRA qualitatively analyzed the degree of financial impact on financial indicators and evaluate it in three stages: large, medium and small. |

|---|

| Type of risk | Risk/Opportunity | Financial Impacts | Financial Impacts | Risk Management, Countermeasures, and Initiatives |

||||

|---|---|---|---|---|---|---|---|---|

| 4℃ | 1.5℃ | |||||||

| Mid term 2030 |

Long term 2050 |

Mid term 2030 |

Long term 2050 |

|||||

| Transition Risks |

Policy and Legal |

|

|

Small | Small | Medium | Large |

|

|

|

Small | Small | Large | Large |

|

||

| Technology |

|

|

Small | Small | Medium | Large |

|

|

| Market |

|

|

Small | Small | Medium | Large |

|

|

| Reputation |

|

|

Small | Small | Medium | Medium |

|

|

|

|

Medium | Large | Medium | Large | |||

| Physical Risks |

Acute |

|

|

Medium | Large | Medium | Medium |

|

| Chronic |

|

|

Medium | Medium | Small | Medium |

|

|

| Opportunity | Products and services |

|

|

Medium | Large | Medium | Large |

|

| Market |

|

|

Small | Small | Medium | Medium |

|

|

Indicators and Targets

Since the status of GHG emissions from the portfolio and emission intensity are key indicators in the real estate sector, NIPPON REIT will monitor Scope 1, Scope 2 and Scope 3 emissions in accordance with the GHG Emissions Reduction Policy to strive for their continuous reduction.

Targets

- Achieve net-zero by 2050.

- Reduce GHG emissions 50% by 2030 (compared to 2016, based on intensity)